Blog Content

13

Nov

2025

For any business insurance for lawn care inquiry, know that it's your essential shield. It protects your business from common risks.

Here's what it typically covers and why you need it:

The lawn care industry is booming, with revenues climbing significantly in recent years. In Massachusetts, from the green lawns of Newton to the manicured estates of Wellesley, lawn care businesses are thriving. But this outdoor work isn't without its risks. "Crazy stuff happens," as one expert put it, like clients tripping over equipment, or even unexpected animal encounters. Without the right protection, one accident could threaten your entire operation.

Insurance isn’t a luxury in the Bay State—it’s the price of admission to serious, long-term success.

Everyone earning money in the green industry:

Even a lone mower can crack a sprinkler head or sling a stone through a $3,000 picture window—costs that come straight out of your pocket without insurance.

Incidents like these happen every season; the right policy turns potential business-enders into manageable inconveniences.

Think of your policy like layered armor—each piece guards a different weak spot. Most owners start with a Business Owner’s Policy (BOP) that bundles liability, property, and business-interruption coverage, then add specialty protections as needed.

CGL pays for third-party injuries, property damage, or advertising-injury claims and picks up legal defense costs. One ankle fracture on a slick lawn can run $30,000+—CGL handles it so you don’t.

Learn more: General Liability Coverage in Massachusetts

Personal auto policies exclude business use. Commercial Auto plugs that gap, covering liability, collision, comprehensive losses, and trailers—essential when you’re hauling gear up and down Route 9. Details here: Best Massachusetts Commercial Auto Insurance.

Zero-turns, blowers, and trimmers move from shop to trailer to jobsite all day. Inland Marine follows them everywhere, paying for theft, transit damage, vandalism, and rented equipment.

Links for deeper dives:

Premium = what you pay. Deductible = what you pay first when a claim hits. Limits = the insurer’s max payout. Balance all three to fit your budget and your risk.

Industry research puts median General Liability around $45/month for landscapers, but real prices swing widely.

Always collect multiple quotes and ask about bundling—10-25 % savings are common.

Knowing these blind spots lets you close gaps before trouble strikes.

Getting insured is quick: share details about services, payroll, and equipment; review quotes; bind coverage—often in 24–48 hours. Once active, you’ll use Certificates of Insurance (COIs) to prove protection to clients.

Most carriers now let you generate COIs online in minutes. Add clients as additional insureds when required—common for commercial sites and high-value homes in Wellesley or Brookline.

Review coverage yearly or whenever you:

Need a second opinion? Book a Free Insurance Policy Review in Massachusetts to confirm your protection keeps pace with your growth.

It's natural to have questions about insurance, especially when you're busy growing your lawn care business. Here are some of the most common questions we hear from folks just like you across Massachusetts, from busy Brookline to serene Needham.

Yes, absolutely! This is one of the most common misunderstandings we see. Even if you're a sole proprietor, you're still personally on the hook for any mistakes that happen on the job. Think of it this way: operating without business insurance for lawn care is like playing a game of chance with your personal savings.

Here's why it's so important:

If you accidentally hit a client's sprinkler system, or a rock flies from your mower and shatters a window, you're personally liable for property damage. Those repair costs can quickly add up!

What if a client trips over your hose or equipment and gets hurt? Without insurance, you could face hefty medical bills, lost wages for the injured party, and even legal fees if they decide to sue. This is called sole proprietor risk, and it puts your home, savings, and other personal assets in jeopardy.

Plus, many clients, especially in areas like Wellesley and Newton, will require proof of insurance before they even let you start working. They want to know they're protected, too.

The good news is that there are often low-cost options available for small operations. Basic general liability coverage can be surprisingly affordable, giving you essential protection without draining your budget. It's a small price to pay to truly protect your personal assets and sleep soundly at night.

No, this is another huge and often costly misconception! Your personal auto insurance policy explicitly excludes business use. This means if you're driving to a job site, hauling equipment, or doing anything related to your lawn care business, your personal policy likely won't cover you in an accident.

Think about it: Your personal policy is designed for things like driving to the grocery store or visiting family. It's not set up for the risks of commercial driving. If you get into a fender bender while pulling your trailer full of mowers, your personal insurer could deny the claim. This leaves you fully responsible for all damages, medical expenses, and legal costs. That's a huge risk of claim denial you absolutely want to avoid!

This is why Commercial Auto insurance is so important for any vehicle you use for your business, whether it's a dedicated work truck or even your personal pickup. And if your employees sometimes use their own cars for quick errands related to work, or if you ever rent a vehicle for a bigger job, you'll want to look into Commercial Hired and Non-Owned Auto Coverage. It's all about making sure you're covered no matter who is behind the wheel for business purposes.

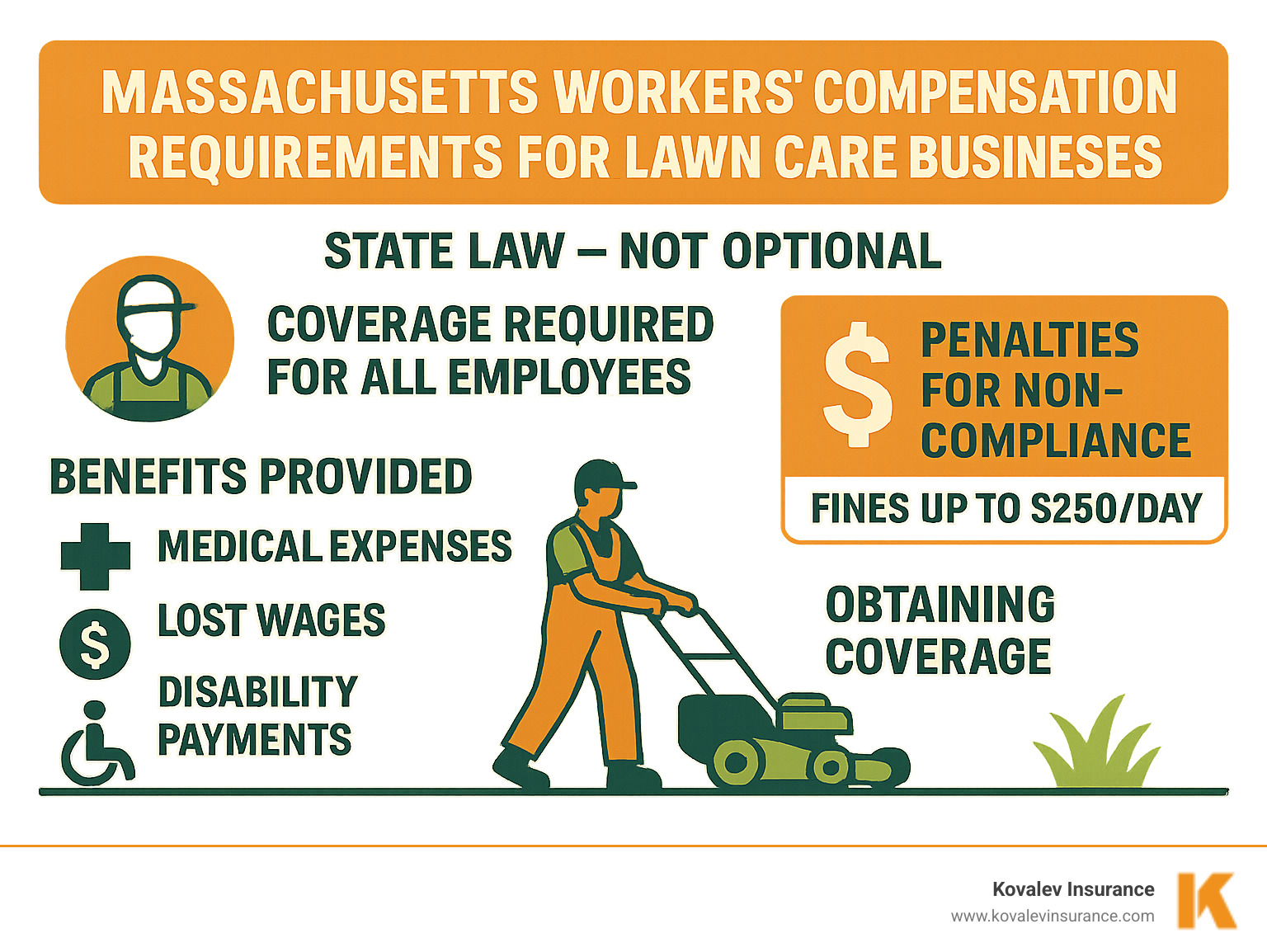

Yes, absolutely! In Massachusetts, workers' compensation is required by law for businesses with employees. This isn't an option; it's a legal requirement with serious penalties if you don't comply.

Here's what you need to know:

If you have anyone working for you who isn't an owner – whether they're full-time, part-time, or seasonal – you generally need workers' compensation coverage. This protects both you and your team. If an employee gets hurt on the job, say, an employee back injury from lifting heavy sod or a cut from equipment, workers' comp steps in.

It covers their medical expenses related to the injury, from doctor visits to physical therapy. It also helps replace their lost wages while they're recovering, typically paying about two-thirds of their average weekly earnings. This helps your employee stay afloat and ensures they get the care they need.

The state of Massachusetts takes this requirement very seriously. The penalties for non-compliance are severe, including hefty fines and even criminal charges. You could also be personally responsible for all the costs of an injured employee's medical care and lost wages. It's simply not worth the risk.

For more detailed information about these crucial requirements, it's always wise to review the latest workers' compensation laws in Massachusetts to ensure your business is fully compliant.

Starting and running a successful lawn care business in Massachusetts takes courage, dedication, and smart planning. The business insurance for lawn care coverage we've explored—General Liability, Commercial Auto, Tools & Equipment, Workers' Compensation, and Commercial Property—gives you the solid foundation you need to build something lasting.

Think of insurance as your business partner that's always got your back. While you're focused on creating beautiful lawns in Newton or maintaining pristine landscapes in Wellesley, your insurance is quietly protecting everything you've worked so hard to build.

Custom protection isn't just insurance jargon—it's the difference between coverage that truly fits your business and a one-size-fits-all policy that leaves gaps. Whether you're a solo operator with a single mower or running multiple crews across Brookline and Needham, your coverage should match your reality.

The beauty of having proper insurance is the peace of mind it provides. You can bid on that high-end property in Belmont without worrying about what happens if something goes wrong. You can invest in new equipment knowing it's protected. Most importantly, you can sleep well at night knowing your business and your family's future are secure.

Your hard work deserves protection. Every early morning, every weekend job, every satisfied customer—it all adds up to something valuable. Don't let one unexpected incident wipe out years of effort and investment.

At Kovalev Insurance, we've been helping lawn care businesses across Massachusetts for years. We understand the unique challenges you face, from dealing with unpredictable New England weather to meeting the high expectations of clients in affluent communities like Natick and Wellesley.

Our local expertise means we know what matters most to your business. We've seen the claims that can happen and the coverage that makes the difference. More importantly, we're committed to making insurance simple and affordable, so you can focus on what you love—changing outdoor spaces and growing your business.

The best time to get business insurance for lawn care is right now, before you need it. Don't wait for that first close call or expensive claim to realize you're underinsured.

Ready to protect your investment and grow with confidence? Get a customized quote for your Artisan Contractor Insurance needs in Massachusetts today. Let's build a protection plan that grows with your business and gives you the confidence to take on any opportunity that comes your way.

Your lawn care business has the potential to thrive in Massachusetts. With the right insurance protection and our support, you can focus on keeping the Bay State's lawns beautiful while we keep your business safe.

X