Blog Content

1

Jun

2025

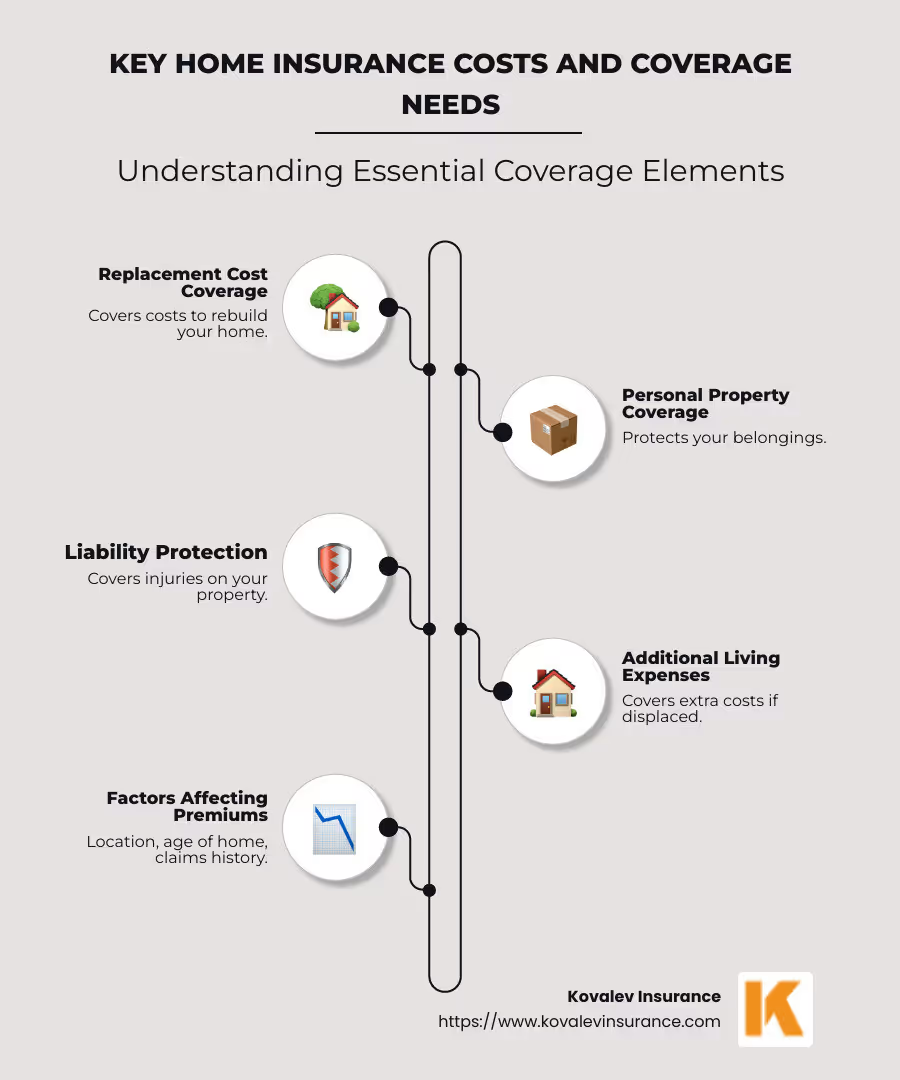

For anyone wondering how much to insure home, especially in Massachusetts, the primary goal is to ensure you have enough coverage to rebuild your home and replace your possessions after a disaster. Here’s what you need to know:

With home values and construction costs on the rise, it’s vital to review these components regularly to prevent underinsurance.

Home insurance is shaped by various factors such as your home's location, age, and your personal claims history. For instance, homes in areas like Newton or Brookline may face different risk assessments compared to those in Natick or Needham. Whether you're concerned about fire risks, wind damage, or other perils, understand the specific coverage you need to safeguard your investment.

I am Mikhail Kovalev, and with over a decade of experience in the insurance industry, I specialize in advising clients on how much to insure a home so they are financially protected against unexpected events. This understanding helps me offer personalized services custom to individual needs.

Now, let’s dig into understanding home insurance costs and explore what factors influence your premiums.

When it comes to home insurance, the cost can vary significantly depending on where you live and what kind of coverage you choose. In Massachusetts, the average annual cost of homeowners insurance is about $1,425, which is higher than the national average of approximately $1,200 per year. This is largely due to the state's exposure to severe weather events like nor'easters and hurricanes, especially in coastal areas like Cape Cod.

The average homeowners insurance policy in the U.S. costs around $1,584 per year. However, this can fluctuate based on several factors, including the amount of dwelling coverage you select. For example, if you opt for $300,000 in dwelling coverage, the average annual rate is about $2,258. But if you're in Massachusetts, you might find yourself paying more due to state-specific risks and higher property values.

Massachusetts isn't the only state with unique insurance challenges. The cost of homeowners insurance can vary widely from state to state. Factors such as local weather patterns, crime rates, and construction costs all play a significant role. In cities like Boston, insurance costs might be influenced by the high population density and the increased likelihood of claims related to theft or vandalism.

Dwelling coverage, also known as Coverage A, is a critical component of your home insurance policy. It covers the cost to repair or rebuild your home if it's damaged by a covered peril. The amount of dwelling coverage you need depends largely on the cost to rebuild your home, not its market value. For instance, a home in Wellesley might have a higher rebuild cost due to the local construction costs, which can affect your premium.

Understanding these factors can help you better estimate how much to insure home. It's essential to evaluate your specific needs and risks, especially if you're living in areas with higher exposure to natural disasters or if your home has unique features that might increase its value.

Next, we'll explore the key considerations in determining how much to insure home, including the replacement cost and coverage limits.

When figuring out how much to insure home, it's crucial to consider several important factors, such as replacement cost, the 80% rule, and coverage limits. Let's break these down.

The replacement cost is what it would take to rebuild your home from scratch using similar materials and quality. This is not the same as the market value of your home, which includes the land and can be influenced by local real estate trends. In Massachusetts, especially in areas like Newton and Wellesley, construction costs can be high. This is why ensure your dwelling coverage is adequate to cover these expenses in the event of a total loss.

Many insurance companies follow the 80% rule. This rule states that you must have coverage for at least 80% of your home's replacement cost to receive full reimbursement for any partial damage. If your coverage falls below this threshold, you might end up paying out of pocket for a significant portion of the repairs. For example, if your home in Needham has a replacement cost of $500,000, you should carry at least $400,000 in coverage to meet the 80% requirement.

Your policy's coverage limits are the maximum amounts your insurer will pay for a covered loss. These limits are crucial because they determine the financial protection you have in place. In addition to dwelling coverage, you'll need to consider limits for personal property and liability coverage. For instance, in Brookline, where property values and personal belongings may be higher, you might need higher coverage limits to ensure full protection.

Evaluating these factors will help you determine the right amount of insurance for your home. It's important to regularly review and update your policy to account for changes in construction costs, home improvements, and personal belongings. By doing so, you can ensure you have the right coverage in place to protect your investment.

Next, we'll dive into the factors that affect home insurance premiums, such as location, the age of your home, and your claims history.

When determining how much to insure home, several factors can influence your home insurance premiums. Understanding these can help you make informed decisions and potentially save money.

Your home's location plays a significant role in determining your insurance premium. In Massachusetts, areas like Boston and Springfield may have higher premiums due to increased risks such as property crime or severe weather. For instance, homes in coastal areas like Cape Cod might face higher rates because of the risk of hurricanes or flooding. Conversely, homes in quieter towns like Natick or Belmont might enjoy lower premiums due to lower crime rates and fewer weather-related risks.

The age of your home can also affect your insurance costs. Older homes, like those found in historic parts of Newton or Brookline, might have higher premiums. This is because they may have outdated systems, such as plumbing or electrical, which pose a greater risk of damage. On the other hand, newer homes in Wellesley with updated construction materials and systems are often seen as less risky, potentially lowering your premium.

Your personal claims history is another factor that insurers consider. If you've filed multiple claims in the past, insurers may view you as a higher risk and charge a higher premium. For example, if you've filed claims for water damage or theft in your Needham home, your rates might increase. Keeping claims to a minimum can help maintain lower insurance costs.

The deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your premium because you're agreeing to pay more upfront if you need to file a claim. However, you need to ensure that the deductible is still affordable for you. For example, if you opt for a higher deductible in Brookline to reduce your premium, make sure you have the savings to cover it in case of a claim.

By understanding these factors, you can better steer the complexities of home insurance and potentially lower your premiums. Next, we'll explore how to calculate your insurance needs based on local construction costs, personal property, and liability coverage.

When figuring out how much to insure home, it's crucial to consider a few key elements: local construction costs, personal property, and liability coverage. Let's break these down.

In Massachusetts, construction costs can vary significantly depending on where you live. For instance, building in Boston or Newton might cost more due to higher labor and material costs compared to towns like Natick or Belmont.

To get an accurate estimate of your home's replacement cost, you can:

Your personal belongings—from furniture to electronics—also need coverage. Imagine flipping your house upside down; everything that falls out is your personal property. It's important to have enough insurance to replace these items:

Liability coverage protects you if someone gets injured on your property or if you accidentally damage someone else's property. This is especially important if you have features like a swimming pool or trampoline, which can increase risk:

By understanding and calculating these factors, you can ensure you have the right amount of coverage for your home in Massachusetts. Up next, we'll explore tips to help you lower your home insurance costs.

Reducing your home insurance costs doesn't have to be complicated. Here are some straightforward strategies you can use:

One of the easiest ways to save on insurance is to bundle your home and auto policies. Many insurers offer discounts when you purchase multiple policies from them.

Your credit score can impact your insurance premiums. A better score often means lower rates.

Choosing a higher deductible can lower your monthly premiums.

By implementing these tips, you can effectively manage your home insurance costs while maintaining the coverage you need. Next, we'll tackle some frequently asked questions about home insurance to further clarify your options.

Homeowners insurance costs can vary significantly based on location, home features, and other factors. In Massachusetts, the average cost is about $1,425 annually for a $300,000 dwelling coverage, which is above the national average of $1,200. This higher cost is due to the state's exposure to severe weather and higher living costs. In cities like Newton, Wellesley, Brookline, Needham, Belmont, and Natick, these costs might vary slightly based on specific local factors.

Coverage Details: A standard policy typically includes dwelling coverage, personal property coverage, and liability protection. It's crucial to ensure that your policy covers the full replacement cost of your home and belongings.

The 80% rule is a guideline used by insurers to determine the minimum amount of insurance coverage homeowners should carry. This rule suggests that homeowners should insure their homes for at least 80% of the replacement cost.

Replacement Cost: This is the amount it would take to rebuild your home from scratch. If you don't meet the 80% threshold, you might face penalties, meaning the insurer may not cover the full cost of damages, leaving you to cover the difference out-of-pocket.

For example, if your home’s replacement cost is $500,000, you should have at least $400,000 in coverage to avoid penalties.

Trampolines and swimming pools are considered "attractive nuisances" by insurers. They can increase liability risks because they pose a higher chance of injury.

Liability Risks: If someone gets injured using your trampoline or swimming pool, you could be held liable, which might lead to higher insurance premiums.

Coverage Exclusions: Some insurers might not cover these features at all, or they may require certain safety measures, such as fencing around pools, to be eligible for coverage.

It's essential to check with your insurance provider to understand how these features could impact your policy and consider additional liability coverage if needed.

By understanding these aspects, you can make informed decisions about your Massachusetts homeowners insurance and ensure you're adequately protected.

At Kovalev Insurance, we understand that finding the right homeowners insurance can be complex, especially with the unique challenges faced by homeowners in Massachusetts. Our mission is to provide you with personalized solutions that cater specifically to your needs, ensuring you have the right coverage without paying more than necessary.

Our team of local insurance experts is well-versed in the intricacies of the insurance industry. We leverage our deep knowledge to help you steer through the various options and select the best policy for your home. Whether you're in Newton, Wellesley, Brookline, Needham, Belmont, or Natick, we offer custom coverage that addresses the specific risks and costs associated with your area.

We pride ourselves on delivering expert knowledge and advice, helping you understand the key factors that influence how much to insure home. From assessing local construction costs to evaluating personal property and liability coverage, we ensure you're fully covered against potential risks.

Our approach is simple: we listen to your concerns, analyze your situation, and provide options that suit your lifestyle and budget. Whether it's bundling policies, improving credit scores, or increasing deductibles, we offer practical tips to help lower your home insurance costs without compromising on coverage.

For a comprehensive review of your current policy or to explore new options, we invite you to reach out. Let us help you protect your most valuable asset with the peace of mind that comes from knowing you're in good hands.

Explore our homeowners insurance solutions in Massachusetts for more information and to get started on securing the best coverage for your home.

X