Blog Content

13

Dec

2025

Plumber professional liability insurance protects your business from costly lawsuits when clients claim your work caused them financial harm. Unlike general liability that covers physical accidents, professional liability covers mistakes, errors, and negligence in your plumbing services.

What Professional Liability Insurance Covers for Plumbers:

As a plumber in Massachusetts, you face unique risks every day. Whether you're installing a new water heater in Newton or diagnosing pipe issues in Wellesley, one professional mistake can lead to thousands in damages. A lawsuit from a client could cost $70,000 or more, and 43% of small businesses have been threatened with or involved in a lawsuit.

The plumbing industry employs over 537,200 workers who work with water, electricity, and gas systems where errors can be expensive. Even experienced plumbers can make mistakes - forgetting a permit, miscalculating pipe sizes, or giving advice that leads to system failures.

We've helped Massachusetts plumbers protect their businesses for over a decade through comprehensive insurance solutions including plumber professional liability coverage. At Kovalev Insurance Agency, we understand the specific risks facing contractors in Brookline, Needham, Belmont, and Natick, and we've guided hundreds of plumbers through choosing the right protection for their unique needs.

Think of plumber professional liability insurance as your safety net for the invisible risks in your work. While you can see a leaky pipe, you can't always predict when a professional judgment call might lead to financial trouble for your client.

This specialized coverage, also called Errors & Omissions (E&O) insurance, protects you when clients claim your professional advice or services caused them financial harm. It's different from general liability; this isn't about dropping a wrench on a client's foot. Instead, it covers financial losses that occur when your professional expertise falls short.

For example, you recommend a specific boiler for a Wellesley home, but it proves to be undersized. The homeowner has to pay for a replacement, costing thousands. This is exactly the kind of situation where plumber professional liability protects your business.

Even when you do everything right, clients can still file claims. Defending your business in court can cost tens of thousands of dollars. Having this coverage also helps you win more work. When potential clients see you're professionally insured, they know you're serious about your craft. It's a badge of professionalism.

For more detailed information on this essential coverage, explore More info about Professional Liability Insurance Massachusetts.

Massachusetts doesn't legally require plumbers to carry plumber professional liability insurance. You won't be fined by the state licensing board for working without it.

However, the real world has its own requirements. Many general contractors won't let you bid on projects without it, as they know uninsured subcontractors can become expensive problems. Smart homeowners in areas like Newton and Needham are also asking for proof of insurance to protect their investments.

Your competition likely has it. When you're competing for a job in Brookline, having professional liability coverage makes you look more professional and responsible. While not legally mandatory, skipping this coverage means missing out on the best jobs and leaving your business vulnerable to financial disaster.

The simple truth is that if you provide plumbing services or advice for a fee, you need plumber professional liability coverage. This applies to all professionals in the industry, regardless of business size or structure. This includes:

Sole proprietors, LLCs, and corporations all face the same professional risks. Smaller businesses often need this protection most, as they lack the financial reserves to handle a major lawsuit.

Many plumbers are confused about the difference between general liability and plumber professional liability insurance. It's an understandable question. Both are crucial for protecting your business, but they cover completely different types of risks.

Think of it this way: general liability covers physical damage, while plumber professional liability covers financial harm from professional mistakes. Having both is essential for comprehensive protection.

Here's how they stack up against each other:

General liability insurance covers physical accidents. For example, if you're working in a Wellesley kitchen and your wrench slips, cracking a granite countertop, GL covers the property damage. It also covers bodily injury, like a client in Newton tripping over your toolbox.

Water damage from active work is another major risk. If a pipe connection fails while you're working and soaks the hardwood floors, this policy responds. Third-party property damage from dropped tools or slips and falls on wet floors are also classic general liability claims.

For more details on this essential coverage, check out General Liability Coverage Massachusetts.

Plumber professional liability protects you when your professional services or advice cause financial loss for a client, even without physical damage. For instance, you advise a Natick homeowner on a new boiler. If it's undersized and needs a costly replacement, they could hold you responsible for the financial loss.

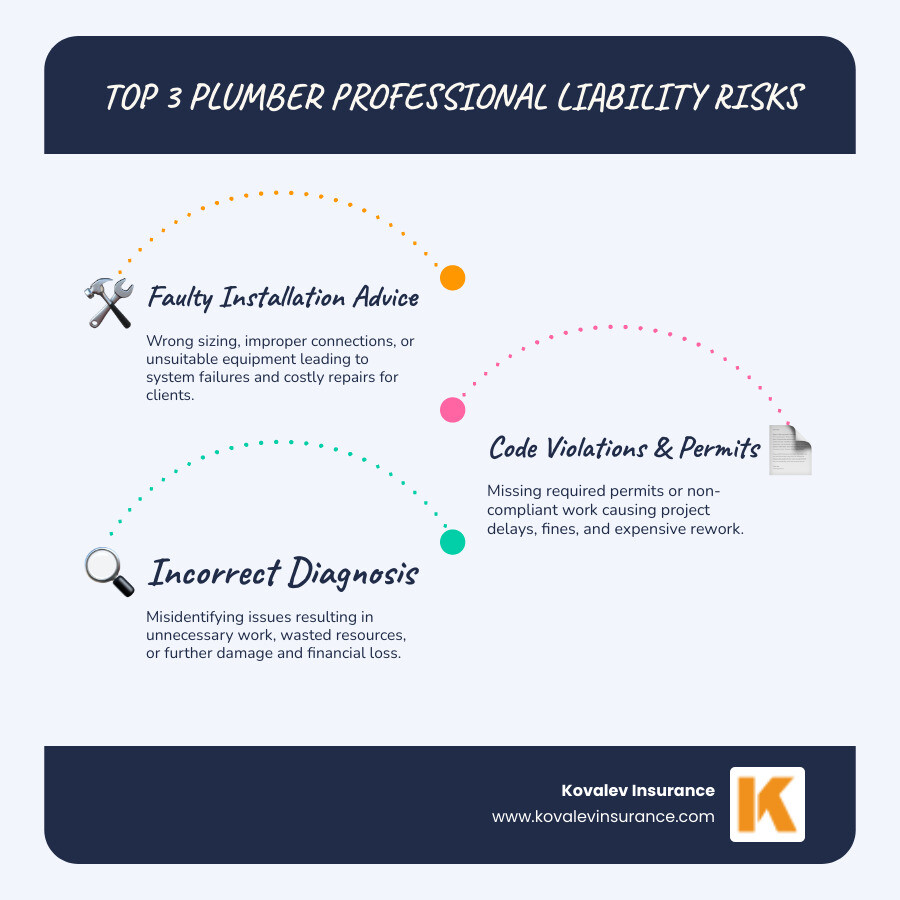

Faulty installation advice is a perfect example. Other common scenarios include incorrect diagnosis of a problem, leading to unnecessary repairs, or design errors in a plumbing system for a home renovation. Code violations from forgotten permits can also halt projects and create expensive delays for clients, leading to claims.

These situations are about the financial harm that comes from professional mistakes, not physical accidents. General liability won't cover these claims, which is why professional liability is so critical. For more insights, Explore Risks Facing Artisan Contractors Mass.

The key takeaway is that you need both policies. They protect against two completely different types of risks you face every day.

When a client claims your professional service caused a financial loss, they may file a lawsuit. This is where plumber professional liability insurance becomes your financial lifeline, protecting your business and your peace of mind.

Imagine you're working on a complex heating system in a Newton home. The client later claims your advice led to costly, ineffective decisions and demands compensation. A lawsuit could cost $70,000 or more, and even baseless claims require expensive legal defense.

Your professional liability insurance handles these legal defense costs, settlements, and judgments. This allows you to focus on your work, keeping Massachusetts homes and businesses running, instead of worrying about a financially devastating lawsuit.

This coverage protects you from the unique risks of providing professional plumbing services. Here's what it typically covers:

While powerful, professional liability doesn't cover everything. Understanding exclusions is key to ensuring you have comprehensive protection through the right combination of policies.

Imagine your successful plumbing business, serving families in Newton and Wellesley, is suddenly faced with a lawsuit over professional advice. Without plumber professional liability insurance, a single claim could threaten everything you've built.

The reality is that 43% of small businesses have been threatened with or involved in a lawsuit. This affects local plumbers and contractors throughout the Greater Boston area. The question isn't if you'll face a claim, but when.

Operating without this protection is a massive gamble. When something goes wrong, the consequences can be catastrophic. For more insights into protecting your business, explore More on Business Liability Insurance Mass.

When a client files a negligence claim, the financial impact is immediate. Without insurance, you pay for legal defense and potential settlements out of your own pocket.

In the plumbing business, your reputation is critical. In communities like Needham and Belmont, word of a lawsuit—even an unfounded one—can quickly damage the trust you've built.

The investment in professional liability insurance is about protecting your finances and the reputation that makes your business successful.

Getting the right plumber professional liability insurance is a smart investment in your business's future. The goal is to find protection that fits your needs and budget.

When shopping for coverage, you'll see terms like policy limits (the max your insurer pays) and deductibles (your out-of-pocket cost). These are tools to customize your protection. Many Massachusetts plumbers save 10-20% by bundling policies, like professional and general liability. For more on this, see our guide on Plumbers Contractor Insurance Mass.

Your premium is based on specific risk factors. Understanding them helps you make informed decisions.

For a small plumbing business in Massachusetts, basic professional liability coverage typically costs around $90-150 per month, but your rate will depend on these factors.

Finding the right policy is a straightforward process. Here are the key steps:

Following these steps will help you secure coverage that protects your business without overpaying.

Your plumbing business is the result of years of hard work and trust earned from clients across Massachusetts. But even the most skilled plumber can face a professional liability claim that threatens it all.

Plumber professional liability insurance isn't just an expense; it's an essential tool for your business, like a pipe wrench or drain snake. You hope you never need it, but you'll be grateful it's there in a crisis.

This coverage offers proactive protection. It shows clients in Wellesley or Brookline that you are a serious professional who stands behind your work, building trust from day one. Many contractors have found that having plumber professional liability insurance helps them win more contracts, as clients feel more confident hiring someone prepared for the unexpected.

The peace of mind this coverage provides is invaluable. You can focus on delivering excellent service—whether recommending a water heater in Newton or diagnosing pipe issues in Natick—with confidence, knowing you're protected.

For plumbers in the Greater Boston area, getting custom advice is key. At Kovalev Insurance, we understand the unique challenges facing Massachusetts contractors and have helped hundreds secure comprehensive protection that fits their needs and budget. Don't let a single claim derail your hard work.

Get a quote for your Artisan Contractors Insurance in Mass and take the first step toward securing your business's future.

X