Blog Content

28

Jun

2025

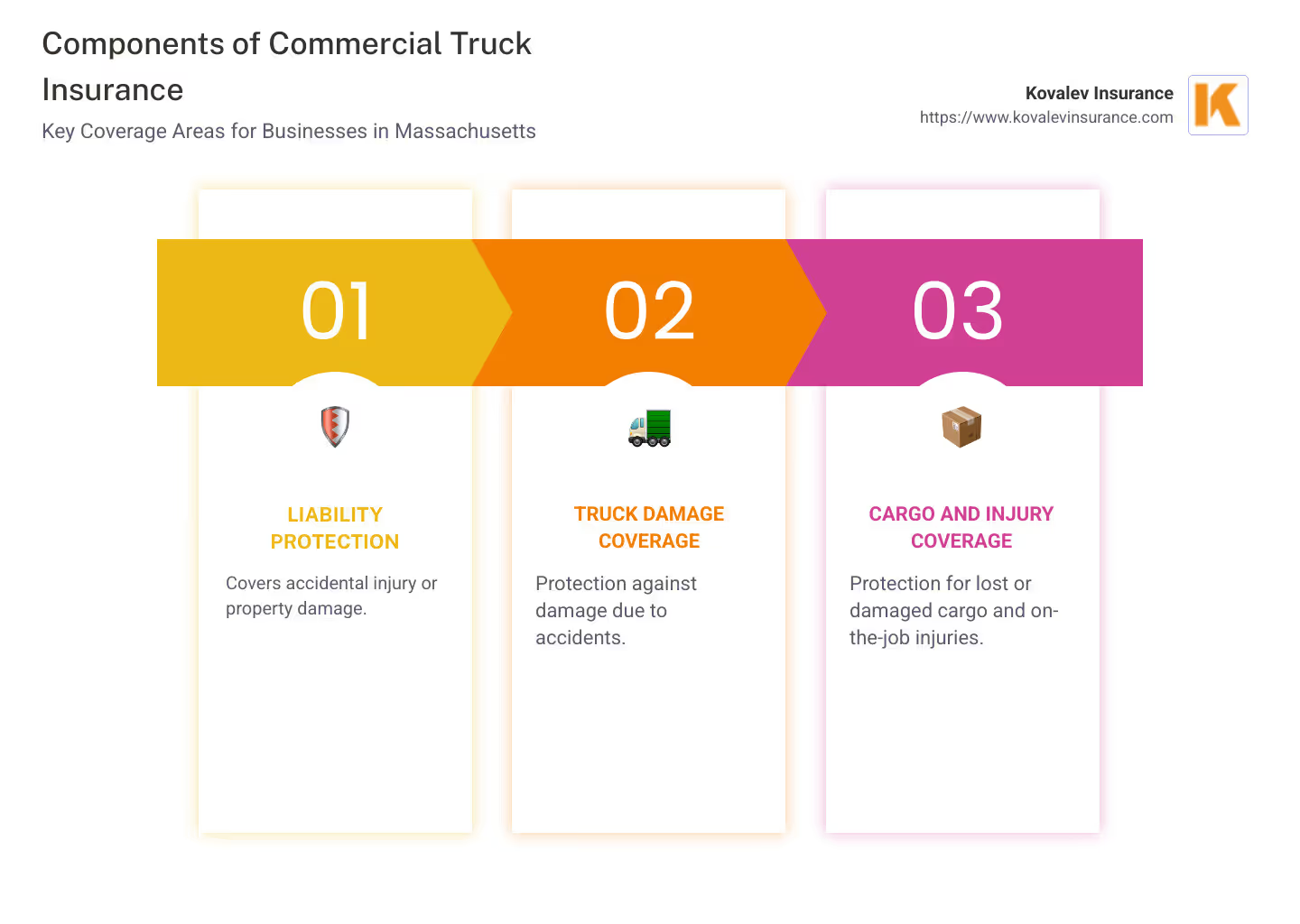

Commercial truck insurance is a crucial component for businesses in Massachusetts looking to protect their investments and ensure compliance with local regulations. For many local business owners, especially in busy areas like Newton, Wellesley, Brookline, Needham, Belmont, and Natick, understanding the ins and outs of this type of insurance is essential. Here’s a snapshot of what commercial truck insurance typically covers:

These components ensure that whether your trucks are navigating the urban streets of Boston or making longer hauls across New England, your business remains shielded from potential financial hardships.

As the second-generation owner of Kovalev Insurance, we have seen the unique challenges faced by local businesses needing commercial truck insurance. From over a decade of expertise in crafting specialized insurance solutions, my team is dedicated to helping you manage risks and protect your assets.

Commercial truck insurance terms to know:

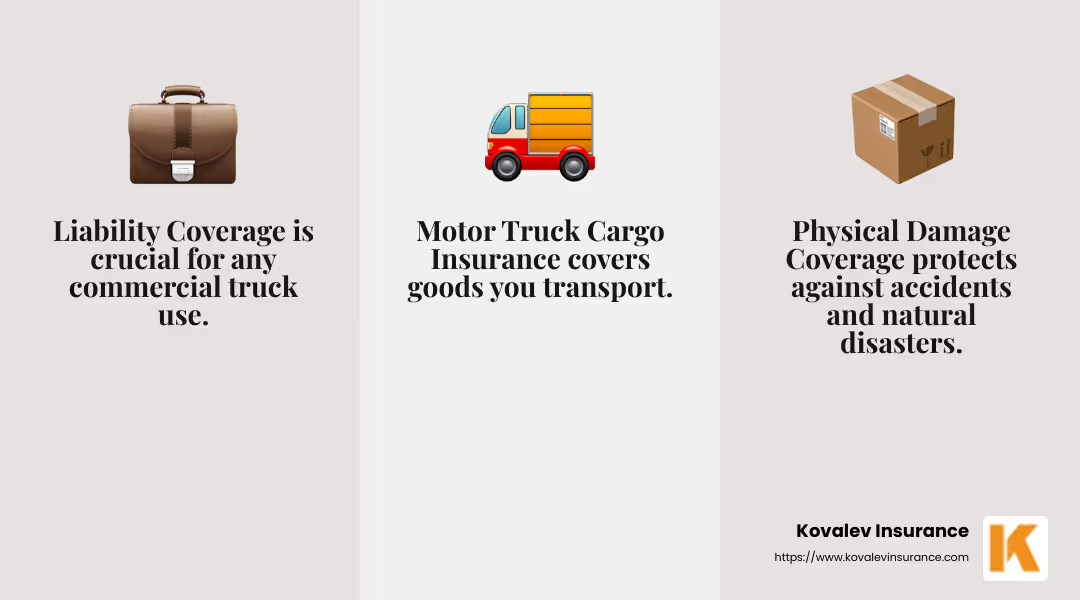

When it comes to commercial truck insurance, understanding the different types of coverage is vital. Here’s a breakdown of the main coverage types:

Different types of businesses and individuals need commercial truck insurance in Massachusetts:

In Massachusetts, whether you’re driving through the busy streets of Boston or the quieter roads of the suburbs, having the right commercial truck insurance is key to safeguarding your business and ensuring peace of mind.

Several factors influence the cost of commercial truck insurance. Understanding these can help you manage and potentially reduce your expenses.

The driving records of those behind the wheel matter a lot. Insurers look at past incidents like accidents or traffic violations. A clean record can lower premiums. Consider hiring experienced and safe drivers. Implement regular training sessions to maintain high safety standards. This not only keeps everyone safe but also keeps costs down.

The type of truck you use affects insurance rates. Larger trucks or those carrying hazardous materials typically cost more to insure. If you're operating in areas like Newton or Wellesley, consider the size and weight of your trucks relative to the narrow roads. Choosing the right truck for your routes can make a difference in your insurance bill.

What you carry matters too. High-value or hazardous cargo increases risk and insurance costs. If your business in Needham involves transporting electronics or chemicals, expect higher premiums. To save, consider diversifying your cargo or improving security measures.

How far you drive impacts your insurance. Trucks traveling longer distances face more risks. If your routes are mostly local, like within Brookline or Natick, you might see lower rates. Adjusting your operating radius or optimizing routes to reduce mileage can be cost-effective strategies.

Prioritize hiring drivers with clean records. Regularly review driving histories and provide ongoing safety training. This not only helps in reducing accidents but also keeps insurance premiums in check.

Managing a fleet efficiently can lead to savings. Use telematics and GPS systems to monitor and improve driver behavior. These technologies can help reduce fuel costs, optimize routes, and lower the risk of accidents.

Implementing a robust risk management policy is crucial. Regular vehicle maintenance checks, safety audits, and having a clear accident response plan can reduce risks. Insurance providers often offer discounts for businesses with strong risk management practices.

In Massachusetts, where weather conditions can be unpredictable and urban areas like Boston have high traffic, these strategies are even more critical. By taking these steps, you can better manage your commercial truck insurance costs and keep your business running smoothly.

Navigating the regulatory landscape for commercial truck insurance in Massachusetts can be complex, but understanding both state and federal requirements is crucial for compliance and cost-efficiency.

Massachusetts has specific regulations that impact transportation insurance requirements. The state mandates certain levels of liability insurance for commercial vehicles, which can differ from personal vehicle requirements. Massachusetts is a no-fault state, meaning your insurance company will pay your injury claims up to a specified limit, no matter who caused the accident. This can influence the types of coverage you need.

For businesses operating in cities like Newton, Wellesley, and Brookline, stay updated on these state-specific requirements. Consulting with a local insurance expert can ensure your coverage meets state standards and is optimized for cost-efficiency.

If your operations involve interstate commerce, complying with federal regulations is mandatory. This includes obtaining a USDOT number and adhering to the Federal Motor Carrier Safety Administration (FMCSA) standards. These federal filings ensure that your business meets the necessary financial responsibility requirements.

For businesses in areas like Needham, Belmont, and Natick, understanding the interplay between state and federal regulations is key. Failing to comply can result in hefty fines and operational disruptions.

Operating in Massachusetts, especially in urban areas like Newton and Wellesley, presents unique challenges. The narrow roads and high traffic can affect the type of trucks you use and the insurance coverage you need. Additionally, weather conditions in Massachusetts can be unpredictable, further impacting insurance considerations.

For businesses in Brookline and Natick, optimizing routes to reduce mileage and adjusting your operating radius can lead to cost savings. Also, implementing technologies like telematics can help monitor and improve driver behavior, crucial for navigating busy urban environments.

By understanding and complying with both state and federal regulations, and considering local factors, you can effectively manage your commercial truck insurance needs in Massachusetts. This ensures that your business remains compliant, cost-effective, and prepared for any challenges on the road.

When you're ready to hit the road, the last thing you want is a delay in getting your commercial transportation insurance. Fortunately, coverage can be initiated almost immediately. This means you can be protected right away, ensuring your business operations are not interrupted. Filings for insurance, which are necessary for compliance, typically have a quick turnaround of 24 to 48 hours. This rapid processing is beneficial for businesses in areas like Newton and Wellesley, where time is of the essence.

Yes, your commercial truck insurance can cover personal use. This flexibility is especially useful for owner-operators who might use their trucks for non-business activities. For instance, if you reside in Brookline and use your commercial truck for personal errands over the weekend, your policy can still provide coverage. This dual-purpose coverage ensures that you're protected, whether you're hauling cargo for business or taking your truck out for a personal drive.

Bobtail insurance is a specific type of coverage designed for situations when your truck is not hauling a trailer. This is important for owner-operators in places like Needham and Natick who may drive their trucks without a trailer attached. Bobtail insurance provides protection during these times, covering incidents that occur when the truck is being used without its trailer. This type of insurance is crucial for maintaining comprehensive coverage and ensuring your business is protected in all scenarios.

By addressing these common questions, you can make informed decisions about your commercial truck insurance needs in Massachusetts. Whether you're navigating the busy streets of Belmont or planning routes through Natick, having the right coverage ensures peace of mind and business continuity.

At Kovalev Insurance, we understand the unique challenges faced by trucking businesses in Massachusetts. From the busy streets of Boston to the quieter roads of Newton and Wellesley, our commercial truck insurance solutions are designed to meet the specific needs of your business.

Our approach is all about personalization. We take the time to understand your operations, whether you're an owner-operator in Brookline or managing a fleet in Needham. This allows us to tailor coverage options that fit your specific requirements, ensuring that your business is well-protected.

With our expert knowledge and years of experience in the insurance industry, we provide more than just policies. We offer guidance and support to help you steer the complexities of insurance regulations and compliance in Massachusetts. Whether it's assisting with state filings or providing insights into cost-saving strategies, our team is here to help you every step of the way.

And because we know that time is critical, especially in areas like Belmont and Natick, we ensure a quick and efficient process to get you covered without delay. Our goal is to provide peace of mind so you can focus on what you do best—keeping your trucks on the road and your business running smoothly.

For personalized solutions and expert advice in commercial truck insurance, reach out to us at Kovalev Insurance. Let us help you safeguard your business with the right coverage.

Explore our services and get in touch today to find out how we can assist you with your commercial trucking insurance needs.

X