Blog Content

28

Nov

2025

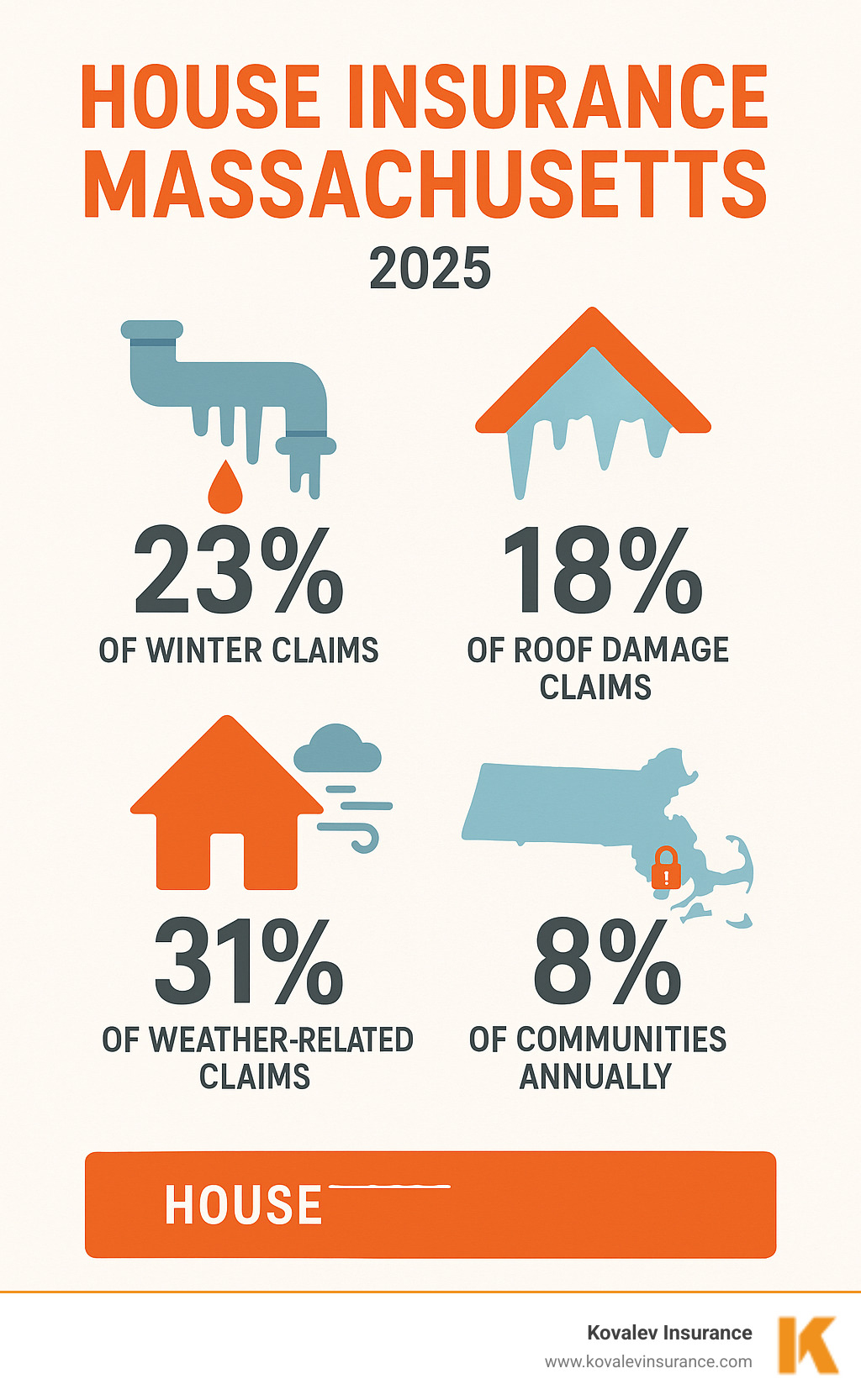

House insurance Massachusetts protects your property from the Bay State’s harsh winters, coastal storms, and some of the nation’s highest building costs.

Quick facts:

At $200–$400 per square foot to rebuild in Newton, Brookline, or Wellesley, even a modest 2,000-sq-ft home can cost $400k–$800k to reconstruct—far more than many sale prices. One bad storm could erase decades of equity if you’re under-insured.

Think of house insurance Massachusetts as a financial safety net. A kitchen fire in Needham or a nor’easter-felled tree in Wellesley can rack up six-figure repair bills in minutes. With the right policy, those costs don’t come out of your pocket.

No state law forces you to buy it, but every lender will. They’ll ask for proof of insurance before closing, require continuous coverage, and list themselves as a loss payee so their investment is protected. Many lenders even collect your premium through escrow to be sure the policy never lapses. More info about is homeowners insurance required in 2025

Massachusetts weather swings from blizzards to hurricanes. Ice dams and frozen pipes cost thousands each winter, while coastal storms threaten homes from Brookline to Natick. On top of that, Boston-area construction costs are 127 % above the national average, so rebuilding is pricey. Skimping on coverage in Newton or Wellesley can put your entire net worth at risk. Are Ice Dams Covered Home Insurance

Your house insurance Massachusetts policy is a contract—know the basics so there are no surprises at claim time. The declarations page lists limits, deductibles, and endorsements; the exclusions list tells you what isn’t covered.

What Does Ma Home Insurance Cover

Personal Flood Insurance Massachusetts

Good news for Massachusetts homeowners: house insurance Massachusetts costs are surprisingly reasonable compared to the rest of the country. The average annual premium is $1,595, which is 24% less than the national average of $2,110. This savings can put hundreds of dollars back in your pocket each year.

Of course, where you live in the Bay State makes a difference. Boston homeowners pay an average of $1,685 per year, while Worcester residents enjoy slightly lower costs at $1,575 annually. The pattern is clear: coastal areas typically cost more due to hurricane risk, while inland communities often benefit from lower premiums.

This geographic variation means your neighbor in Newton might pay more than someone with a similar home in Worcester, simply because of location-based risks.

Average Home Insurance Massachusetts

Understanding what drives your house insurance Massachusetts premium helps you make smarter coverage decisions. Several key factors work together to determine your final cost.

Location is the biggest factor outside your control. A coastal property in Newton faces higher premiums because of hurricane risk, while an inland home in Worcester typically enjoys lower rates. Even within the same town, your specific address matters - proximity to fire stations, local crime rates, and building codes all influence pricing.

Home age and construction significantly impact what you'll pay. Those charming historic homes in Belmont with original electrical systems and plumbing often face higher premiums due to increased fire and water damage risks. Newer homes or those with recent updates typically qualify for better rates because they're less likely to have problems.

Fire protection proximity affects your premium more than you might expect. Homes within 1,000 feet of a fire hydrant and 5 miles of a fire station in Natick typically receive better rates than rural properties with limited fire protection. Insurance companies know that faster emergency response means less damage.

Claims history influences pricing both for you personally and your entire neighborhood. Areas with frequent claims see higher premiums across the board, while claims-free homeowners often qualify for significant discounts. Your personal track record matters too - multiple claims can increase your rates.

Credit score plays a role in Massachusetts insurance pricing. Insurers use credit-based insurance scores to predict claim likelihood, with better credit typically resulting in lower premiums. It's worth monitoring your credit score for insurance savings alone.

How Replacement Cost Estimated

Your coverage decisions directly control a significant portion of your premium. Understanding these choices helps you balance protection with affordability.

Dwelling coverage amount represents the largest factor in your premium calculation. Massachusetts homes typically carry $300,000 in dwelling coverage, but homes in Newton, Wellesley, and Brookline often require $500,000 to $1,000,000 or more due to higher construction costs. While higher coverage costs more, being underinsured can be financially devastating.

Liability limits affect your premium, but the cost difference between $100,000 and $300,000 in liability coverage is often minimal compared to the additional protection provided. This is usually one of the best insurance values you can buy.

Deductible amount works inversely with your premium - higher deductibles mean lower premiums. Choosing a $2,500 deductible instead of $500 can reduce your premium by 20-30%. Just make sure you can comfortably afford the higher out-of-pocket cost if you need to file a claim.

Replacement cost versus actual cash value coverage for personal property affects both your premium and potential claim payments. Replacement cost coverage costs more upfront but pays to replace items at current prices rather than depreciated values. For most homeowners, this upgrade is worth the extra cost.

Understand Home Insurance Costs Mass

A standard policy is a solid start, but Bay State homeowners often need more.

Proactive maintenance keeps your family safe, reduces stress, and helps you qualify for the best house insurance Massachusetts rates.

Insure the dwelling for full replacement cost (not market price). In Greater Boston that can run $250–$400 per sq. ft. Personal property is usually 50 % of that, but a quick home-inventory app confirms if you need more. For liability, most homeowners choose $300k–$500k; high-asset households often add an umbrella.

Yes, though premiums may be higher if electrical, plumbing, roof, or heating systems are outdated. Upgrades and safety devices help. If a standard carrier declines you, the FAIR Plan will provide basic coverage.

Usually yes—your liability coverage responds. Some carriers restrict certain breeds (e.g., pit bulls, Rottweilers). Always disclose pets to your insurer. For details see Any Ma Home Insurance Pit Bull Dogs.

Your Massachusetts home deserves protection that goes beyond just satisfying your mortgage lender's basic requirements. Between the Bay State's harsh winters, coastal storm risks, and some of the nation's highest property values, you need house insurance Massachusetts coverage that truly safeguards your investment.

Think about it - your home in Newton, Wellesley, or Brookline represents decades of hard work and financial planning. One major storm, house fire, or liability lawsuit could wipe out everything you've built without proper insurance protection. That's not a risk worth taking.

At Kovalev Insurance, we've spent years helping Massachusetts homeowners steer these exact challenges. We understand that a historic home in Belmont has different insurance needs than a new construction in Natick. We know which coverage options matter most in coastal areas versus inland communities.

Our personalized approach means we take time to understand your specific situation. Do you have valuable art or jewelry that needs special protection? We'll recommend scheduled coverage. Worried about flood risk near the Charles River? We'll help you evaluate flood insurance options. Concerned about liability exposure given your property values? We'll discuss umbrella coverage that makes sense for your situation.

The peace of mind that comes with comprehensive house insurance Massachusetts protection is invaluable. When the next nor'easter hits or an unexpected accident occurs, you'll rest easy knowing you have the right coverage in place.

Don't put off this important decision. Property values in Needham, Brookline, and throughout greater Boston continue rising, which means replacement costs keep climbing too. The coverage that seemed adequate last year might leave you underinsured today.

Ready to protect your most valuable asset with coverage designed specifically for Massachusetts homeowners? Let's discuss your options and find the policy that gives you complete confidence in your protection.

X